Uncover the story of MabilisCash and see how we provide fast, secure, and reliable financial

solutions. Learn about our values, journey, and dedication to simplifying your financial life.

Let our story inspire your path to financial freedom.

Brand Spotlight

Brand Spotlight

Uncover the story of MabilisCash and see how we provide fast, secure, and reliable financial solutions.

Learn about our values, journey, and dedication to simplifying your financial life. Let our story inspire your path to financial freedom.

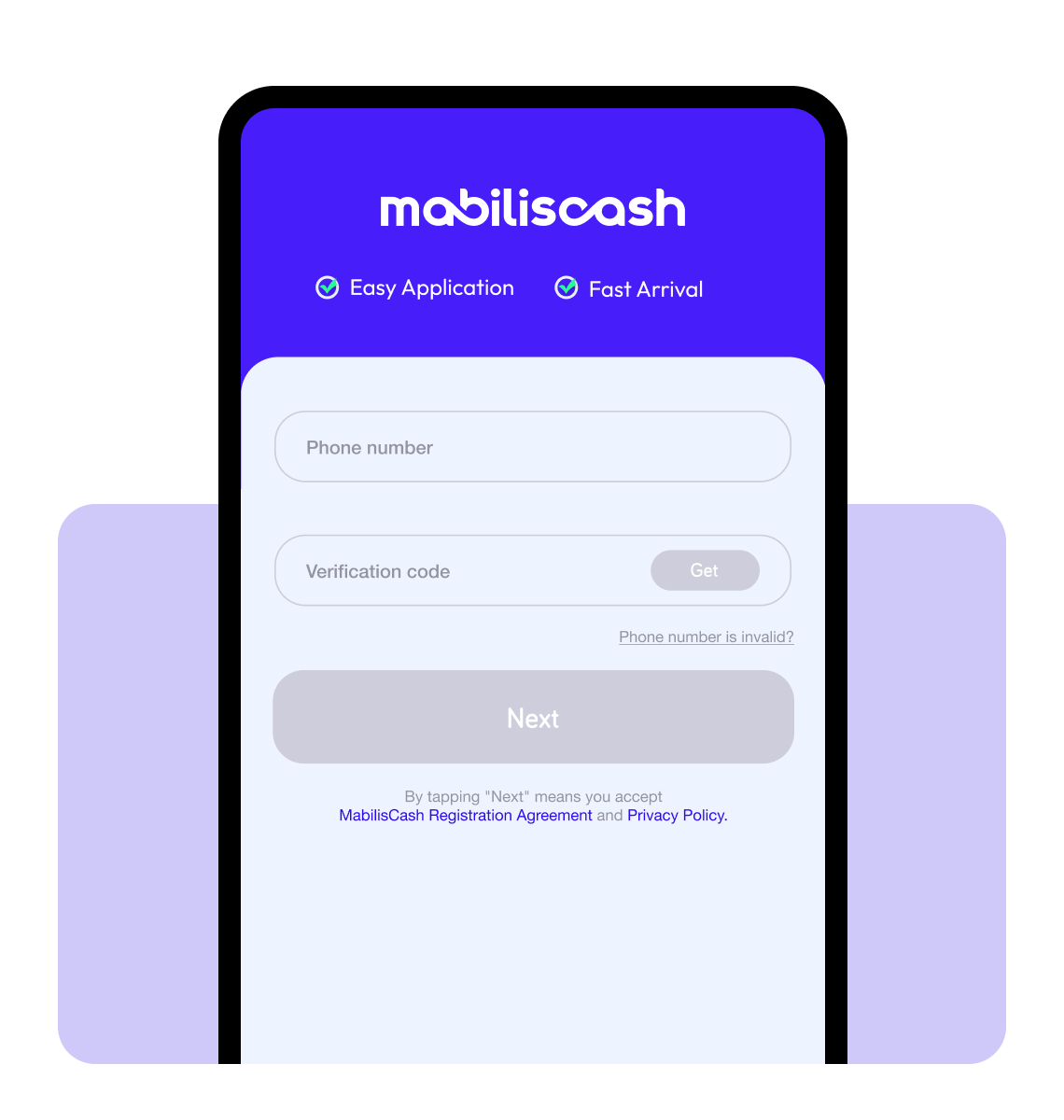

Features of Our Products

10s to register

You only need 10 seconds to register your account.

1min to apply

The application process can be done in 1 minute.

5mins to get loan

Take 5 minutes to calculate your loan amount.

Loan amount up to 90,000

You can get up to 90,000 real-time application.

How to Borrow?

1

Download the MabilisCash APP and register

2

Fill out your information

3

Wait for approval

4

Submit a loan order and get money

5

Repay on time

Recently Added

Business & Finance

Why Your Credit Score Matters — and How to Improve It

In today’s digital world, your credit score is more than just a number — it’s a key that can unlock financial opportunities. At MabilisCash, we believe that empowering users through sound financial education leads to long-term trust and success. Here’s a guide to help you understand credit scores, manage debt responsibly, and build a stronger financial future.

#### What Is a Credit Score?

A credit score is a numerical representation of your repayment behavior. It indicates to lenders how reliably you’ve managed past obligations like loans or credit cards. In the Philippines, a strong credit score can help you:

- Fast-track loan approvals

- Access larger loan amounts

- Enjoy more favorable terms or lower interest rates

#### What Affects Your Credit Score?

Key factors include:

- Payment history – Consistently paying on time is critical

- Outstanding debt amount – How much do you owe across all loans?

- Credit mix – Do you have a variety of credit types?

- Length of credit history – How long have you had accounts open?

#### Five Simple Ways to Improve Your Score

- Always pay before or on the due date

- Only take loans you’re confident you can repay

- Track your debt with apps or calendars

- Avoid applying for multiple loans at once

- Start small—timely repayment of even small loans builds credit history

#### What If You Have No Credit History?

Everyone starts without a credit record. A small loan from MabilisCash repaid on time is a great way to begin building a positive credit history.

#### Managing Debt the Right Way

Having debt is not a flaw—it’s how you manage and repay it that makes the difference:

- Prioritize high-interest or urgent debts

- Create a repayment calendar or reminder system

- Avoid impulsive borrowing

- Reach out for support early if you face repayment challenges

#### How MabilisCash Supports Your Journey

MabilisCash reports repayment behavior, which means responsible borrowing through our platform can help you improve your credit profile over time.

#### In Summary

A strong credit score opens doors to better financial opportunities. With proper planning and smart decision-making, you can build lasting financial stability and trust.

25 July 2025

Press Release

Why Trust Matters: How MabilisCash Puts Your Security and Confidence First

Choosing a financial partner is a serious decision — especially when it comes to online lending. At MabilisCash, we understand the responsibility that comes with handling your financial information and providing credit when you need it most. That’s why we are committed to earning and keeping your trust.

Here’s how we make sure your experience with MabilisCash is safe, transparent, and reliable.

#### Transparent Terms and Conditions

We believe in no hidden fees and clear repayment terms. Before you confirm your loan, you’ll always see:

- The total loan amount

- The exact repayment date(s)

- The interest and service fees (if any)

This way, you can make informed decisions and avoid unpleasant surprises.

#### Fast, But Responsible Lending

Speed matters — especially during emergencies — but so does responsibility. MabilisCash is designed to provide **fast approval** while still **assessing each application carefully** to ensure the loan is manageable for the borrower.

We don’t want users to overborrow. Our system adjusts your credit limit based on your repayment history, helping you borrow within your means.

#### Data Privacy and Security

Your personal information is protected using advanced encryption technology. We comply with local data privacy regulations and have strict internal controls in place.

- Your data is never shared with third parties without consent

- All transactions are encrypted and securely stored

- Only authorized personnel can access sensitive information

#### Professional Customer Support

Have questions or concerns? Our customer service team is here to help. We aim to respond quickly, clearly, and respectfully to all inquiries. Whether you’re applying for your first loan or need help with repayment, we’re always just a message away.

#### Positive Credit Building

We help you **build your credit profile** by reporting positive repayment behavior. Responsible use of MabilisCash can improve your creditworthiness over time — unlocking access to better financial opportunities in the future.

#### Real Stories, Real Users

Thousands of satisfied users have already trusted MabilisCash. Many return for second or third loans not just because of the convenience, but because they feel secure and respected as borrowers. Their stories inspire us to keep improving.

#### Our Promise to You

MabilisCash is more than just a loan app — it’s a partner in your financial journey. We are here to support you not just when you need funds, but also when you need clarity, confidence, and control.

**Trust is built on transparency, reliability, and respect — and that’s what we stand for.**

Thank you for choosing MabilisCash.

07 August 2025

Press Release

Mali Lending Corp. Joins Manila Tech Summit 2025

Mali Lending Corp. proudly participated in the Manila Tech Summit 2025, one of the most influential technology and innovation conferences in the Philippines. The summit gathered industry leaders, fintech innovators, regulators, and technology experts to discuss the future of digital transformation in the country.

##### Showcasing Innovation in Digital Lending

At the summit, Mali Lending Corp. highlighted its commitment to responsible digital lending, financial inclusion, and technology-driven solutions. The company’s booth drew strong interest from attendees who wanted to learn more about its digital lending services and ongoing innovations in the fintech space.

Company representatives also shared insights on:

- The role of fintech in expanding financial access for underserved communities

- Best practices in data privacy and fraud prevention

- How mobile technology is reshaping borrowing habits in the Philippines

##### Strengthening Partnerships

The Manila Tech Summit 2025 provided an opportunity for Mali Lending Corp. to connect with potential partners, technology providers, and policymakers. By engaging with stakeholders across industries, the company aims to further enhance its digital platform, improve customer experience, and contribute to the growth of the Philippine fintech ecosystem.

##### Commitment to Financial Inclusion

Mali Lending Corp. reaffirmed its mission of providing safe, fast, and transparent lending solutions to Filipinos. As the demand for digital financial services continues to grow, the company is investing in innovation and user education to ensure that financial tools remain both accessible and trustworthy.

##### Looking Ahead

Participation in the Manila Tech Summit 2025 marks an important milestone for Mali Lending Corp. The company remains dedicated to advancing its digital lending services, promoting financial literacy, and building stronger connections within the technology and financial communities.

##### About Mali Lending Corp.

Mali Lending Corp. is a licensed lending corporation in the Philippines that provides secure and transparent financial services through innovative digital platforms. The company is committed to making financial access simple, reliable, and inclusive for Filipinos nationwide.

02 September 2025

Business & Finance

How Technology and Local Partnerships Make Borrowing Easier for Filipinos

Managing money isn’t always easy — especially when unexpected bills, school fees, or family emergencies come up. That’s why at MabilisCash, we’re always looking for better ways to make borrowing simple, fast, and secure for everyone.

Over the past few years, we’ve seen how technology can transform the lending experience. With the help of AI-powered tools, our app can now process loan requests more efficiently and recommend offers that best match your needs. It’s all about making sure you get the right support — without unnecessary delays or complicated steps.

But innovation doesn’t stop at technology. We also believe that the best solutions come from working together. By partnering with local banks, fintech companies, and community organizations, MabilisCash is able to reach more Filipinos who need access to reliable credit. These partnerships help us understand real financial challenges — and design services that truly fit local needs.

Of course, trust matters just as much as speed. That’s why we continue to prioritize compliance and data security. Every loan processed through MabilisCash follows local financial regulations and strict privacy standards, so you can borrow with confidence knowing your information is safe.

With more than 5 million installs, MabilisCash has grown into one of the Philippines’ most trusted digital lending apps — but what we’re most proud of is how many lives we’ve been able to help along the way. Whether it’s helping a student pay for tuition, supporting a small business, or covering a medical expense, each story reminds us why we do what we do.

At MabilisCash, our mission is simple: to empower Filipinos through accessible, responsible, and technology-driven lending. Because when borrowing becomes easier and safer, everyone has a better chance to move forward.

03 November 2025

Lifestyle

Holiday Shopping in the Philippines: Smarter Ways to Manage Your Budget This Season

In the Philippines, the holiday season isn’t just a few weeks long — it starts as early as September and peaks from November to January. With Christmas gatherings, gifts for family, school expenses, and home improvements, this period becomes the biggest spending season of the year.

But this year, Filipino shoppers are approaching holiday shopping differently. Instead of last-minute purchases, people are planning earlier, spreading out expenses, and looking for financial flexibility that matches real-life needs.

Here’s what’s changing — and how MabilisCash fits into today’s shopping habits.

#### 1. 13th Month Pay Shapes Holiday Spending — But It’s Not Enough for Everyone

Most Filipinos rely on their 13th month pay to cover:

- Christmas gifts for family

- Noche Buena preparations

- Travel back to the province

- Bills and school-related expenses

But many employees receive it late December, while most expenses come early — gifts, groceries, travel tickets, decorations.

This gap is why more shoppers need short-term support before their bonuses arrive.

#### 2. The Rise of “Spread-Out Spending”

Instead of doing all Christmas shopping in one go, Filipinos now buy:

- Gifts in early November

- Home upgrades mid-December

- Grocery bundles right before Christmas and New Year

This pattern helps avoid peak prices but also stretches the budget thin.

Shoppers want to buy early while deals last — but cash flow doesn’t always keep up.

#### 3. Essentials > Luxury: Practical Holiday Spending

Compared to previous years, Filipinos are prioritizing:

- Appliances for the home

- School supplies

- Kitchen tools

- Gifts that are “useful, not just cute”

- Travel expenses to visit family

Practical spending makes budgeting more predictable — but when multiple needs pile up at once, the pressure increases.

#### 4. Why More Filipinos Use Short-Term Loans During the Holidays

Short-term loans like MabilisCash are becoming part of responsible planning, helping users:

- Bridge the gap before 13th month pay

- Secure early holiday discounts

- Avoid late bills during the most expensive month

- Cover travel or balik-probinsya costs

- Prepare for school fees and home repairs before the new year

It’s not about spending more — it’s about managing timing and cash flow.

#### 5. How MabilisCash Supports Holiday Budget Planning

✔ Fast approval and instant disbursement

Perfect for early shopping or urgent expenses.

✔ Flexible repayment terms

Borrow short-term and settle once your 13th month pay or January salary arrives.

✔ Higher limits for repeat users

Returning borrowers get more flexibility during peak season.

✔ Simple requirements

A mobile phone and one valid ID — no long processes, no heavy paperwork.

With MabilisCash, users can focus on the holiday celebrations instead of worrying about tight cash flow.

#### 6. Smart Ways to Prepare for the Rest of the Holiday Season

As the busiest months (November–January) continue, here are ways to stay ahead:

- List essential expenses and deadlines

- Allocate gifts by priority

- Compare grocery bundle prices early

- Prepare a buffer for unexpected costs

- Use short-term financing to smooth out peak spending

A budget that’s flexible leads to a holiday that’s stress-free.

#### Final Thoughts

Holiday spending in the Philippines is deeply meaningful — it’s about family, generosity, and tradition. But it also comes with financial challenges, especially with overlapping expenses and delayed bonuses.

With responsible planning and tools like MabilisCash, Filipinos can enjoy the season with confidence, secure essential purchases, and manage their finances smoothly from Christmas to the New Year.

14 November 2025

Trusted Partners

Affiliations